Mining Pool Rates: What You Really Pay to Mine Crypto

When you join a mining pool, a group of miners who combine their computing power to solve blocks and share rewards. Also known as mining collective, it’s how most people mine Bitcoin and other proof-of-work coins today. But not all pools are created equal. Your mining pool rates—the fees, payout structure, and payout frequency—can eat up half your earnings if you’re not careful.

Miners don’t just pay a flat fee. Pools charge pool fees, a percentage taken from your share of rewards, usually between 0% and 3%. Some pools charge nothing upfront but make you wait weeks for payouts. Others pay daily but take 2% or more. Then there’s the hash rate, your machine’s raw computing power. If your hash rate is low and the pool has high fees, you’re better off mining alone—even if you rarely find a block.

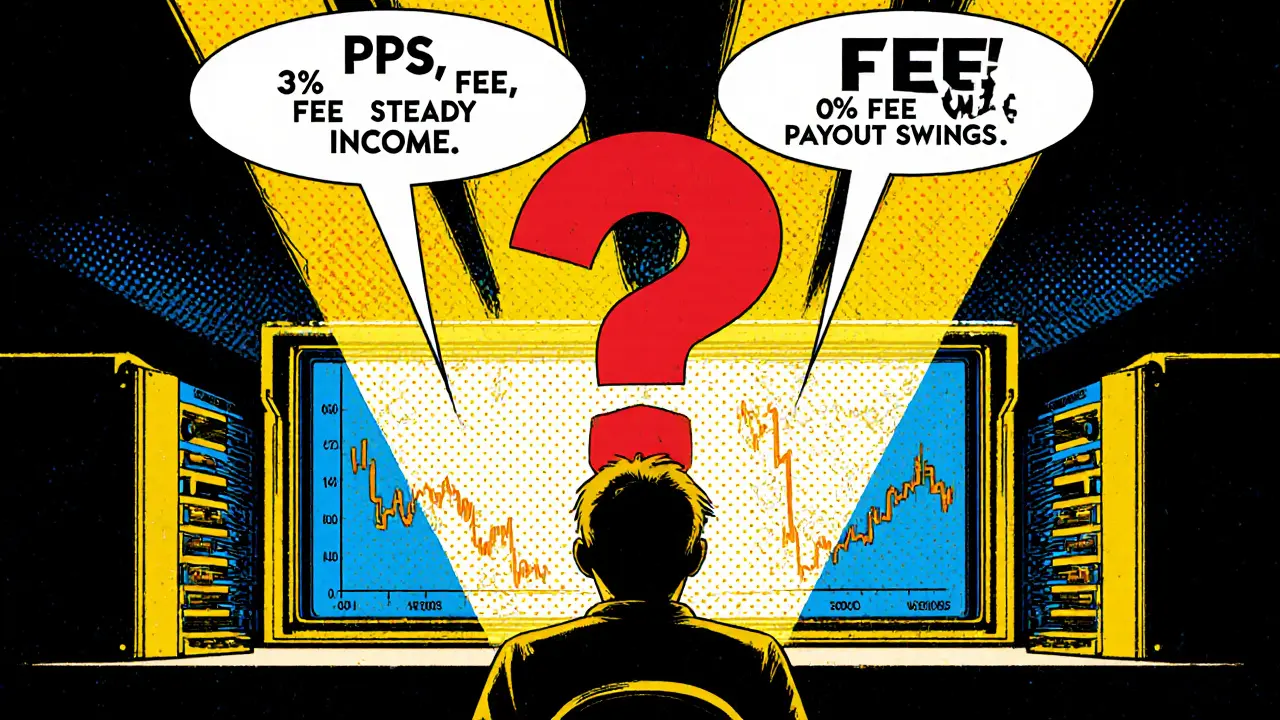

What you’re really comparing isn’t just the fee. It’s how fast you get paid, how stable the pool is, and whether it’s still profitable after electricity and hardware costs. Some pools offer PPLNS, Pay Per Last N Shares, which rewards you based on recent contributions—great if you mine consistently. Others use PPS, Pay Per Share, which pays you upfront for every valid share, no matter if the pool finds a block. PPS is safer but often comes with higher fees.

And don’t ignore the pool’s uptime. A pool that goes down for hours during a Bitcoin difficulty adjustment? You lose mining time—and money. Some pools hide their historical performance. Others publish real-time stats: hashrate, payout history, even miner count. The best ones let you test them with small payouts before committing your rig.

There’s no magic number for the "best" mining pool rate. It depends on your hardware, your location, and how much you’re willing to wait for cash. A low-fee pool might sound great until you realize you’re waiting 14 days for your first payout. A high-fee pool that pays daily might actually give you more usable cash in a month.

Below, you’ll find real-world reviews of mining setups, pool comparisons, and breakdowns of how fees impact your bottom line. Some posts expose shady pools that promise high returns but vanish after a few payouts. Others show exactly how much you can make on a $500 ASIC miner after power and pool costs. No fluff. No hype. Just what works—and what doesn’t—when you’re trying to turn electricity into crypto.